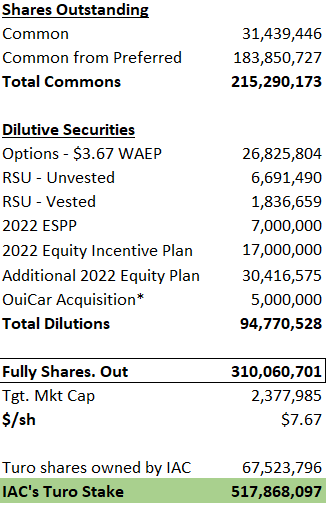

IAC owns a ~27% equity stake in Turo

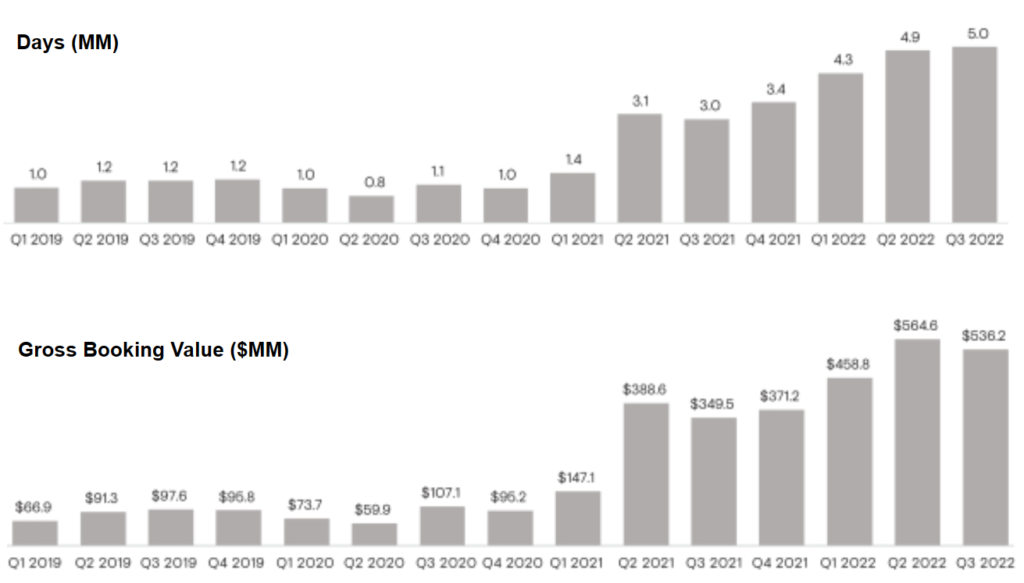

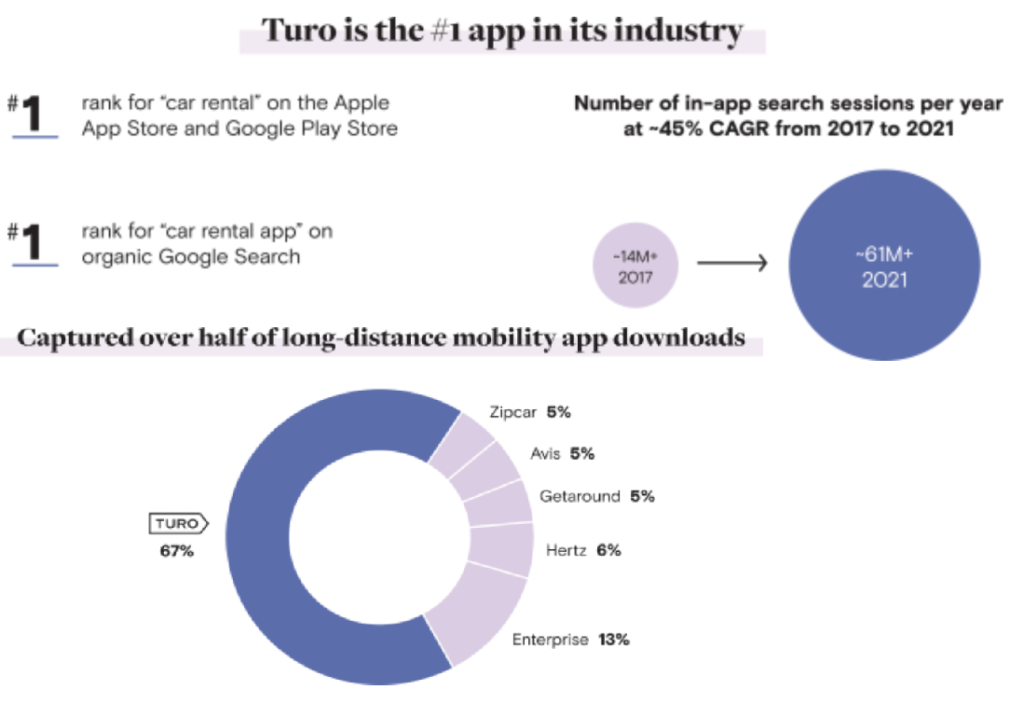

As of the end of Q3/22, IAC holds a 26.7% interest in Turo on a fully diluted basis in the form of preferred shares. Turo is a privately owned company providing peer-to-peer car sharing marketplace akin to what airbnb provides for real estate rentals. Per Turo’s preliminary proxy filing of Dec 14, 2022, the company is currently the largest car sharing marketplace globally. As of twelve months ending Q3/22, the platform boasts 160,000 active hosts, 300k vehicles active across 10,000+ cities in Canada, UK, France, US, Australia as recent launch in Nov 2022, and 2.7+ million active guests that grew 110% y/y. The company launched in 2010.

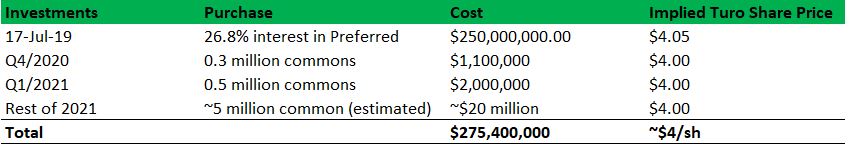

IAC’s cost basis associated with this ownership is approximately $275 million by my estimate, based on IAC’s disclosures of purchases made in July 2019 (initial stake), Q4/20, Q1/21, and H2/21.

Turo performance steller; I estimate fair value above IAC's cost basis

Forecast for the future

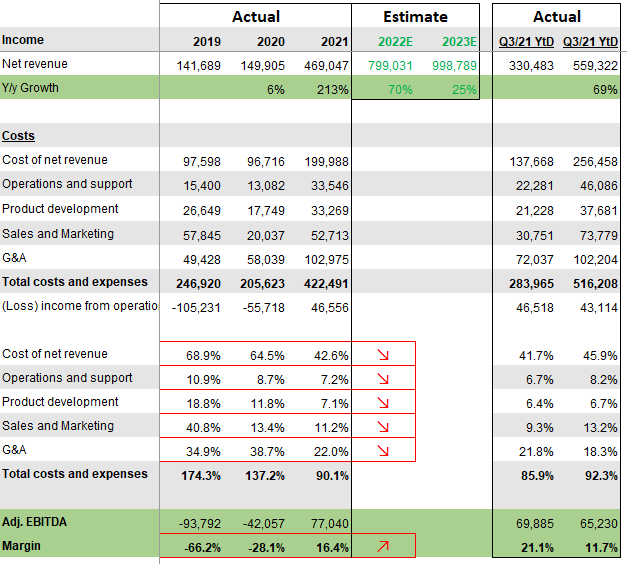

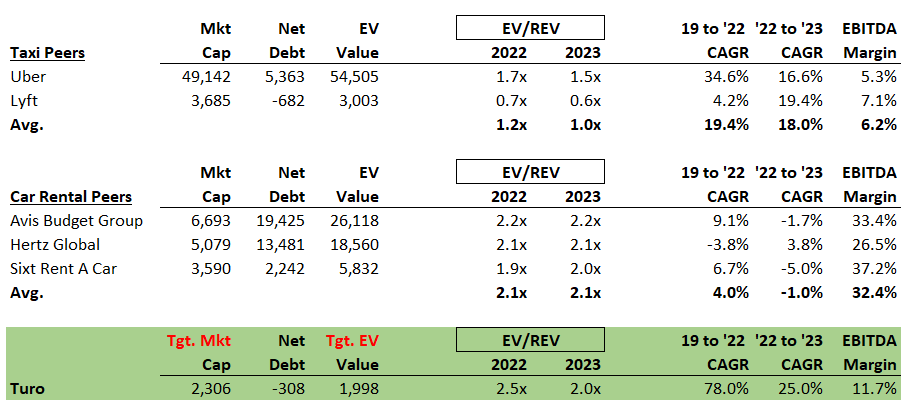

Nonetheless, it’s difficult to surmise what the future holds in store for Turo. With relatively scarce disclosures available, the only line items that I’d propose to forecast with passing threshold of reliability are the FY2022 and at most FY2023 net revenue figures. Q1 to Q3 2022 revenue grew 69% from same period of 2021. Historically over the past 3 years, Q4 revenue constituted 27% to 29% of FY revenue, so bearing these relationships, I estimate Y2022 revenue at ~$800 million (with Q4 revenue amounting to 30% of FY revenue). This would result in a 70% revenue growth for 2022. Consensus estimates on Turo’s competitors imply a sequentially deteriorating year for the car renting industry in 2023 with essentially flattish growth.

Turo Comps

For comps, Turo’s publicly traded car-renting peers that I came across are Avis Budget Group, Hertz, HyreCar, Sixt Rent-a-car, and Getaround. Uber and Lyft can be also thought of as a adjacent competitors as both companies predominantly generate revenue from providing non-ownership transportation services substitutable with car-renting.

This divergence in performance in my estimation appears to at least partially stem from Turo’s rental model, which I view as superior and more convenient than are traditional car rental model in which renters undergo a more tedious process for renting a car.

Turo Valuation

IAC's Turo stake equates to $5.8/sh IAC share

How much is Turo worth