Post Views: 2,318

I’ve recently explored how much IAC’s stake in Turo was worth. See here.

This one is on how much the Search segment within IAC is worth.

IAC's Search segment

IAC’s Search segment consists of 1) Ask Media Group (a collection of websites, search engines, blogs) and 2) the Desktop business (a collection of legacy desktop browser applications and websites providing access to function specific tools/online content etc). Both divisions generate revenue via display of advertisements and affiliate marketing on its websites, with the majority of advertisements displayed by both supplied by Google pursuant to various services agreements, though some ad inventory is also provided by non-google programmatic ad networks.

In my view, Search operates with mediocre prospects, but the segment still holds a meaningful portion of value for IAC because its performance is stable enough, on a sufficiently large revenue base.

Search's Desktop business not great

The Desktop business is being phased out as IAC has indicated that the evolving e-commerce ecosystem is rendering browser-applications offerings obsolete. Revenue from this business is predominantly generated from advertising of paid listings presented to users via the results of their browser-app search queries. A minor portion of revenue is also generated from subscriptions fees paid by users of downloadable desktop applications.

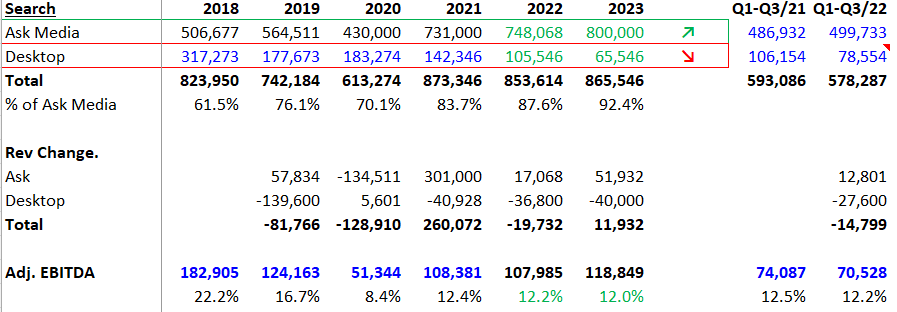

Since at least 2018, Desktop revenue has declined y/y because of what appears to me to be the obsolescence of browser-applications. IAC has also explicitly disclosed that the Desktop business has been adversely impacted by various Google Service Agreement policies changes enacted from Jul 1, 2019 to Aug 27, 2020. In Q4/20, Google also suspended some of Desktop products, further exacerbating sales decline concurrent to effects of Covid. The effects of Google policies changes continued to dissolve Desktop revenue in 2022. This in my opinion will extend into future years as IAC exits the Desktop business. For FY2022 and FY2023, I forecast Desktop revenue of $106 million and $66 million, respectively, predicated on the assumptions that revenue from this legacy business continues to decline at 2020 to 2021 pace.

But Ask Media Group fares better

On the brighter side, revenue has grown at Ask Media Group as the portfolio of Ask Media websites evidently gained traction with internet users. The Ask Media Group is the focus for the Search segment. This business consists of a collection of niche-based websites providing information and general search services. Revenue are generated from affiliate marketing and advertising from the websites. Notable constituents within the Ask Media portfolio include

- Ask.com – a search engine also providing a variety of content on entertainment, travel, and lifestyle;

- Reference.com – a search engine with content on sciences, history, and liberal arts;

- ConsumerSearch.com – a website with consumer focused content including gadgets, family/pets etc.

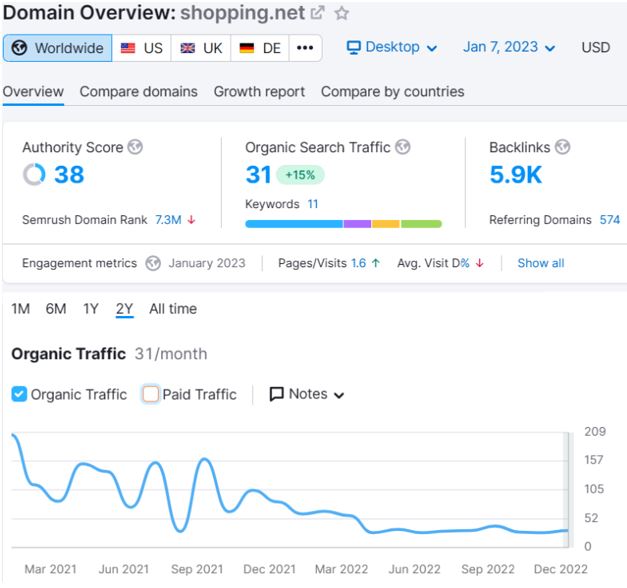

- shopping.net – a search engine catering to shopping related queries

- OhDeal – a search engine querying consumer related deals – a blog with lifestyle content such as homemaking, dating, parenting, or general life.

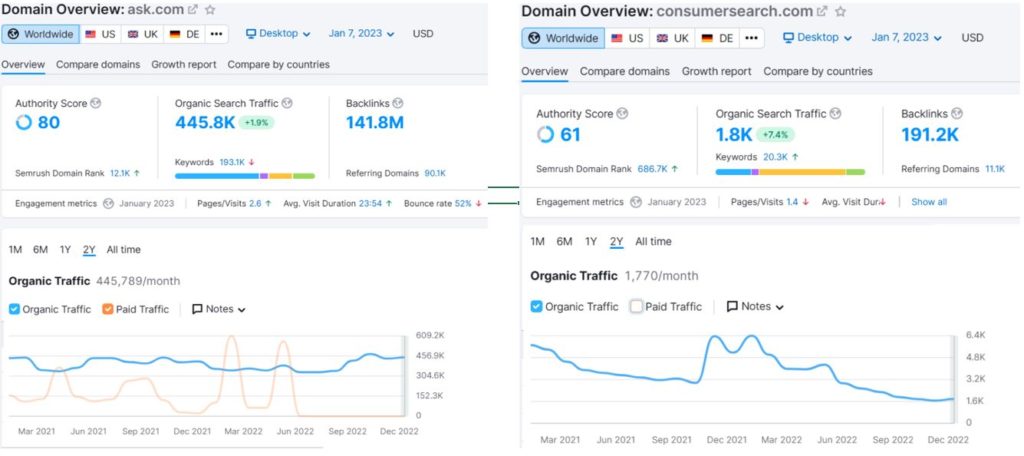

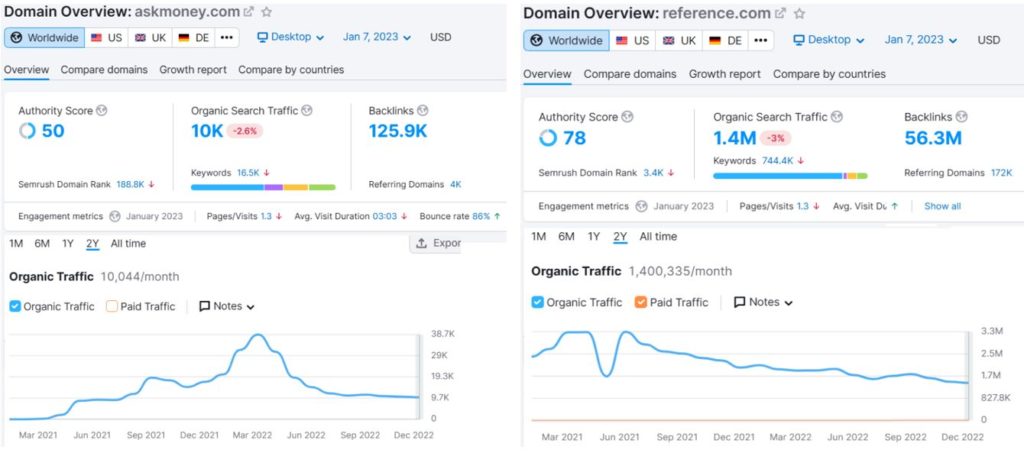

From 2018 to 2022, Ask Media grew revenue in all years except for 2020 in which Covid-disruptions brought about slow-down for the industry. Nonetheless, recovery in 2021 more than offset revenue loss in 2020 and elevated revenue to new highs. Increased visitor traffic has continued to fuel revenue growth in 2022. Thus far, Ask Media appears to maintain healthy growth momentum. However, a closer look under the hood suggests to me that not everything is swell as the division top sites have all been losing traffic in 2022, portending further slow down for 2023.

With considerations to Ask Media sites experiencing some traffic declines, I forecast Ask Media revenue of $748 million for FY2022 and $800 million for FY2023, based on the outlook that 2022 finishes marginally better than 2021 and 2023 seeing some recovery in organic site traffic, just so that I am not overly pessimistic in my expectations.

EBITDA trickier to estimate

As for EBITDA, the figure is harder to forecast as IAC does not break down the respective margin for the dying Desktop Business and the growing Ask Media Business, but past several years of figures clearly shows that as Desktop revenue declined in proportion to Ask Media, margin has declined, indicating to me that Desktop held thicker margin. Going forward, for 2023, I forecast 12% EBITDA margin for 2023 on what I suppose to be higher margined Desktop revenue being replaced by the relatively lower margined Ask Media revenue.

So how much is Search worth?

The Search segment will by my estimate generate in FY2023 $800 million revenue, with ~12% EBITDA margin or $118 million EBITDA. GOOG with ~40% margin is trading at 3.7x NTM revenue and 9+x NTM EBITDA, so Ask should be trading at a much lower multiple. At 4x EBITDA multiple, Search would be worth $475 million, or $5.35 per IAC share.

How much is IAC’s Search segment worth