Post Views: 2,904

What is Dotdash Meredith

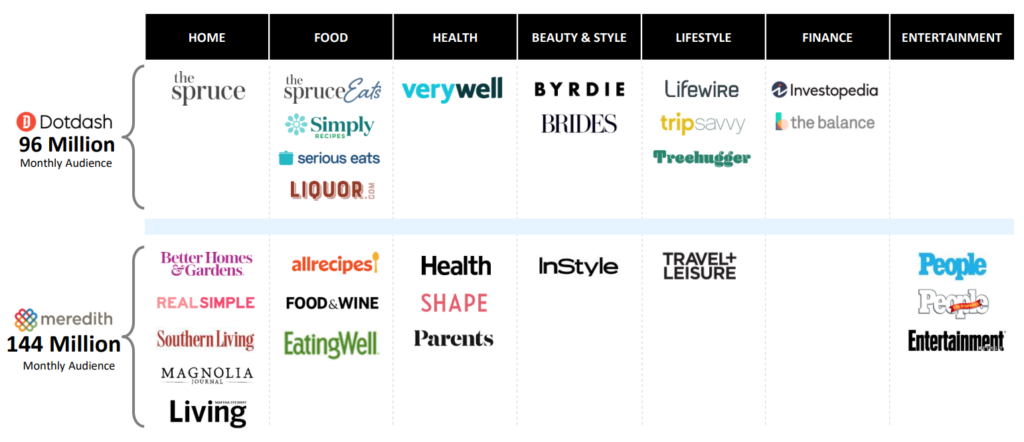

Dotdash Meredith operates a portfolio of 40+ brands of digital content and printed magazines reaching an audience of 200 million+ users who are mostly women. The business comprise of 1) IAC’s legacy company called Dotdash – which consists of a collection of digital-only branded content, and 2) Meredith National Media – acquired on Dec 2, 2021 and consisting of a collection of digitally and printed magazines brands.

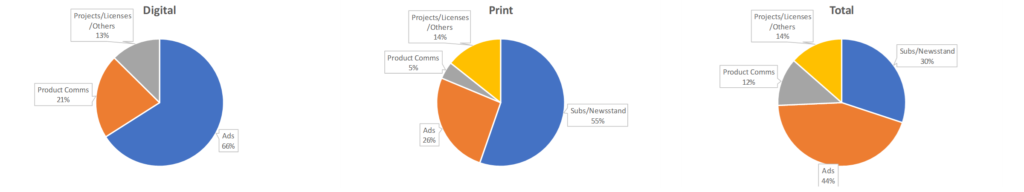

Together, these publishers generate revenue via 1) display of advertising; 2) commission generated from advertised products sold; 3) licensing of Dotdash Meredith brands; 4) subscriptions/newsstand of printed magazines; 5) custom works for advertisers including custom publishing, marketing, search engine optimizations etc. Revenue from the digital and printed businesses are about even (45%-55%), with the printed magazines operating a lower margin and strategically sustained to maintain brand awareness for supporting the online/digital business, which is the predominant generator of bottom line. As of 2022, EBITDA from digital segment is in the mid-teens while printed magazine EBITDA is in the LSD. Because the preponderant of the bottom line is generated from digital business and roughly 2/3 of digital revenue are advertising while 20% are commission of advertised products sold, the main driver of the Dotdash Meredith business are online digital advertisements and online sales of advertised products.

How's performance so far

Since its purchase of Meredith in Dec 2021, Dotdash Meredith has experienced a tough 2022. On the bottom-up, the integration of Meredith assets into the Dotdash platform has run into hiccups, causing delays to revenue ramp up previously projected at acquisition. IAC explained that the migration of Meredith publishing content/brands to Dotdash platform has been more difficult than anticipated, and technical capabilities were challenged in the execution process. This resulted in a drag on website traffic and related revenue in Q1 to Q3 2022. The company claimed on the Q3/22 earnings call that these issues are largely behind the company heading into the year end. However, it’s plausible to me that the some aftereffects of integration issues lingers into 2023. Further, the company noted that traffic to its websites generally decline in the initial months after integration onto the Dotdash platform, so even for the sites that’ve successfully gone through integration, traffic will take several months to recover beyond levels pre-integration. On the top-down, advertising demand were weak, with rapid declines in mid 2022 from several categories including retail CPG and home. In aggregate, the double-whammy of a friction-laden integration process and weak macro advertising demand resulted in a underwhelming year for Dotdash Meredith.

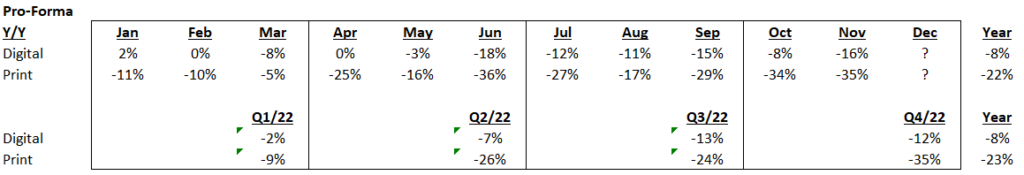

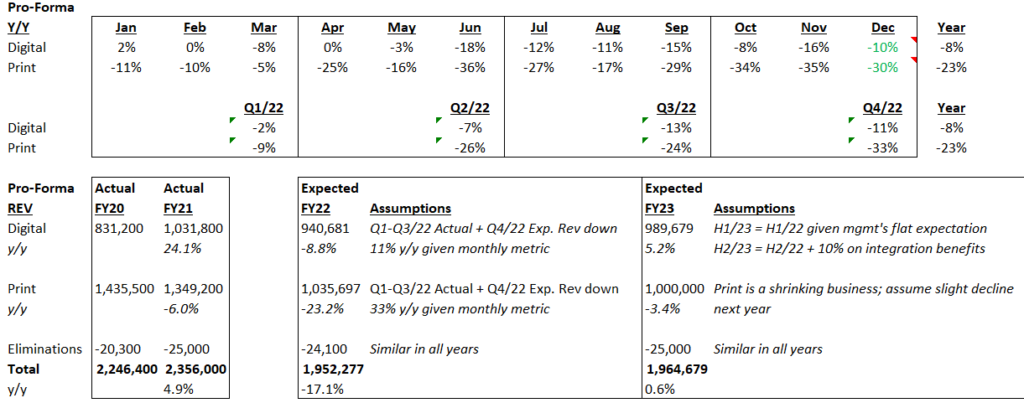

On a pro-forma comparable basis, both digital and print revenue are down on a y/y basis for every month in 2022. Print revenue has deteriorated at a faster pace than has the digital business while negative revenue momentum for both segments accelerated throughout the year and into the year end.

The future of Dotdash Meredith

On a forward looking basis, management expects H1/23 prospects to remain flattish on choppy and stagnant advertising demand while H2/23 to see some growth from reaping from Dotdash’s post-integration efforts. It’s worth highlighting here that even for the back half of 2023, management does not project a much more robust advertising market. Instead, IAC stated on Q3/22 that “Overall, we are not sanguine on the ad market, especially in the first half of the year. And so we are focused on our need in improving our sales, driving the consumption increases, and we’re really in that fine-tuning mode of content, ad serving e-commerce on the Meredith sites.” In essence, growth next year will have to come from the success of Dotdash’s post-integration efforts, with little tailwind from an advertising environment expected to remain tough.

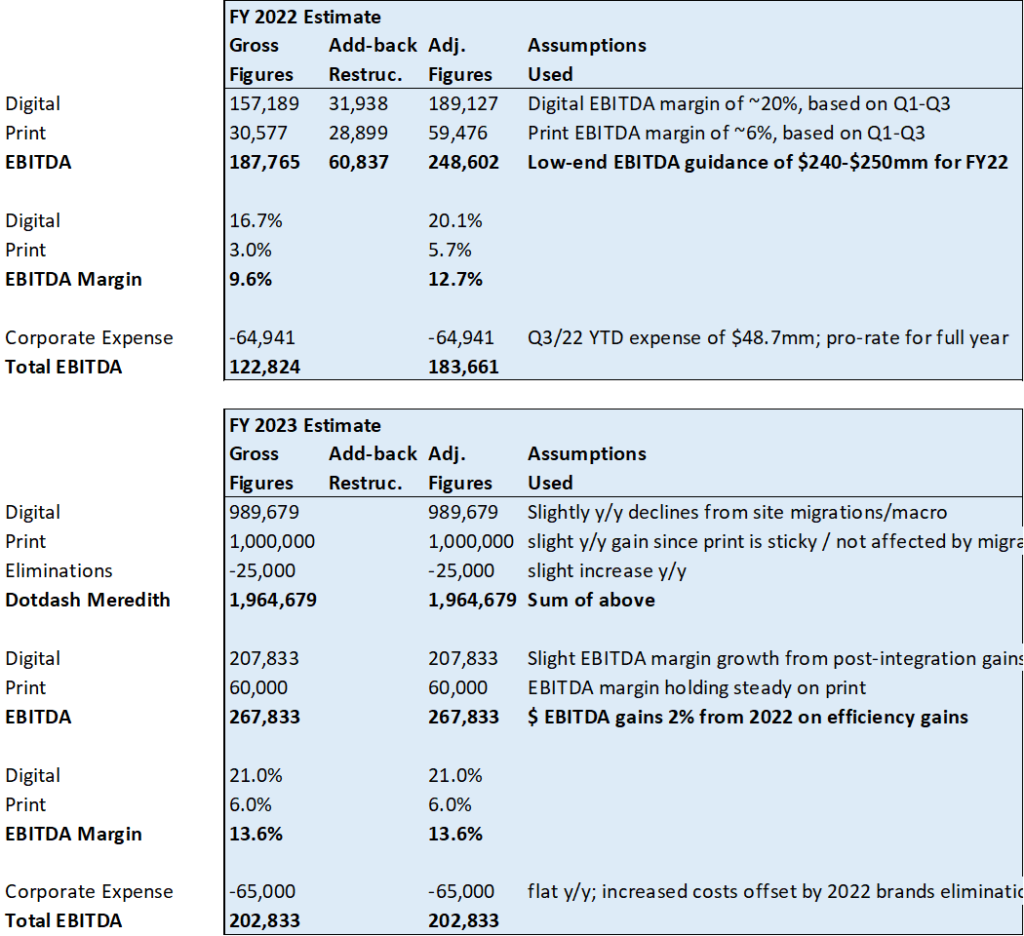

For forecast, my assumptions are predicated on 1) 2023 sees slightly improved EBITDA margin from efficiency gains of Meredith-Dotdash integration; 2) industry advertising demand will be weak in the first half but recover somewhat in the 2nd half. Global ad analytics firms have repeatedly revised lower 2023 outlooks. A WSJ article in Dec 2022 listed 2023 ad spend outlook from several research firms. The range for 2023 ad spend growth rate varies from 4.8% to 6.5%, down from mid-to-high single digits a few months earlier, so I’d conservatively assume digital sales topline remain flat in H1/23 per management’s outlook while H2/23 sees a slight pick up of 10% from y/y 2022; 3) print revenue continues to tumble on what appears to me to be a secular decline independent of the current environment.

I forecast Dotdash Meredith revenue to be ~$1.96 billion for FY2022 and essentially flat for 2023.

Revenue flat for 2023, EBITDA slight improvement

For EBITDA, I assume 2023 digital print EBITDA of 21% and print EBITDA of 6%, on par with those of FY2022. These assumptions yields to digital EBITDA of $208 million and print EBITDA of $60 million. Unallocated corporate expenses attributed to Dotdash Meredith remains at $65 million, pretty much offset by the print EBITDA, as expected by management.

The following illustrates the EBITDA assumptions and logic in details.

Over the longer term, IAC’s aspirational outlook envisions the current ~20% EBITDA margin on the digital business growing to mid-30%, fuelled by the drive into e-commerce.

“We are at a point of really negative leverage, given the revenue declines. And so we’ve said — we expect a marginal dollar of digital revenue to produce $0.50 to $0.60 on the dollar on EBITDA. We’d actually expect the next X amount of revenue to be at a much higher margin, given fixed cost and the nature of it. We’ve seen it in some of the private players, Red Ventures, others that would be comparable to certain things we’re doing. But those — we feel pretty good about getting to mid-30s margins on an EBITDA basis overall. It’s hard to talk about the — because you’ve also got different categories. And if we drive — the more we drive e-commerce, the higher those margins will be.”

This may be an achievable target, but I’ve been dissapointed by enough management teams touting aspirational targets that invariably had issues materialising, so I wouldn’t bank on the digital business growing to a 30% margin anytime soon, especially given current macro-headwinds weighing on revenue growth required for the said margin expansion.

How much is Dotdash Meredith worth?

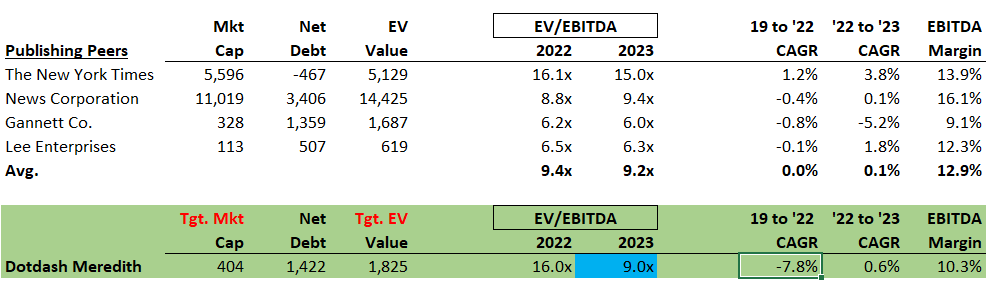

So how does Dotdash Meredith stack up to peers? Based on the few US public comps found, I find it hard to argue for Dotdash Meredith trading at parity with NYT, because NYT has a slightly higher margin, seems to have been / are growing at a faster rate, and notably holds better + more concentrated brand name. Conversely, I’d think that Dotdash Meredith would still fetch a higher valuation than would Gannett and Lee Enterprises, which are traditional news-centric publishers that seem stale to me. So, I strike the middle ground by assigning Dotdash Meredith with multiple that is the group average that is the blended reflection of all the publishers I found.

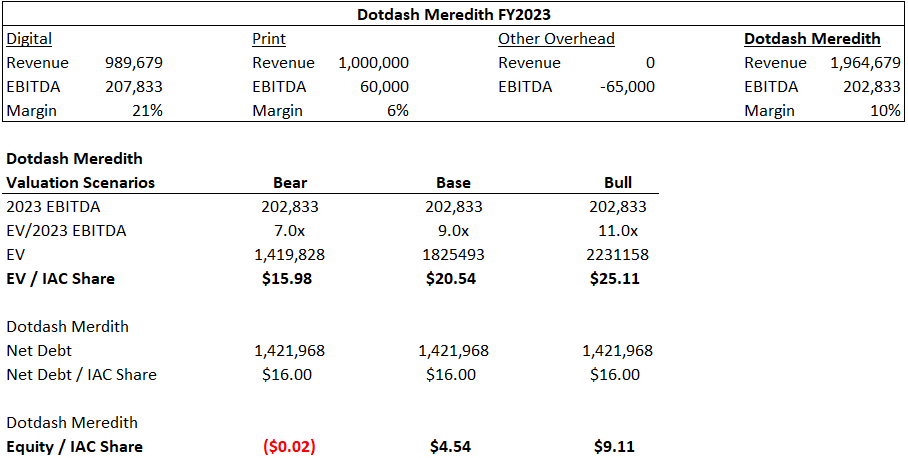

At 9x 2023 EBITDA, Dotdash Meredith is worth $1.8 billion in EV or $20.5 per IAC share. Minus Dotdash Meredith net debt of $1.4 billion, equity value would be worth $400 million, or $4.5 per IAC share.

IAC Valuation – Dotdash Meredith