Post Views: 2,006

IAC's Public Stakes

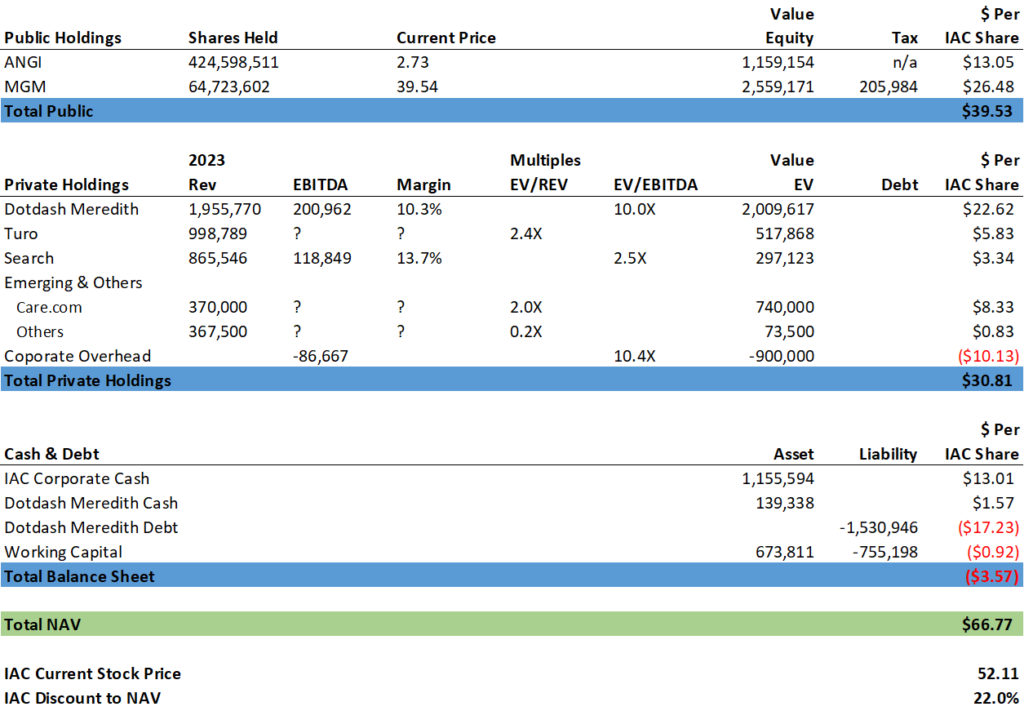

As of Jan 16, 2023, IAC’s publicly traded stock holdings comprise of 1) ANGI Inc. (ANGI) and 2) MGM Resorts International (MGM).

ANGI Stake

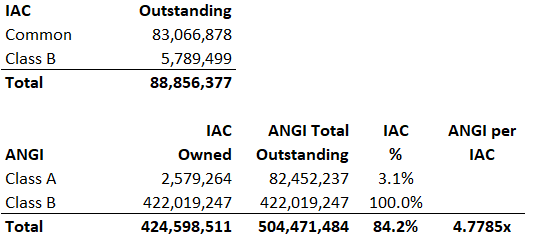

In ANGI, IAC owns 2,579,264 class A shares and 100% of ANGI Class B shares.

MGM Stake

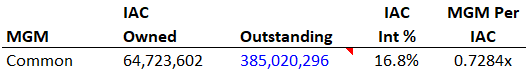

In MGM, IAC owns 64,723,602 common shares, roughly 17% of MGM shares outstanding.

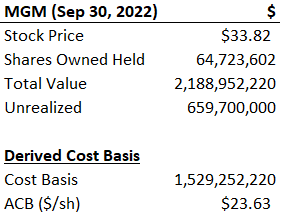

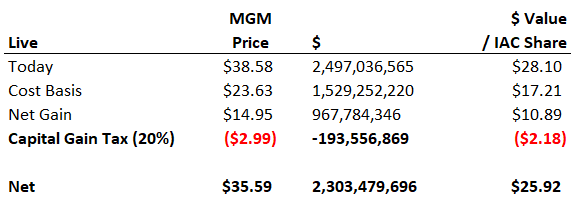

The average cost basis of IAC’s MGM stake is by my estimate $23.63/sh derived from MGM’s disclosures as of Sep 30, 2023.

My implied cost basis puts IAC’s MGM holding value, net of 20% capital gain tax, at $26 per IAC share.

IAC Public Stake total value

IAC’s ANGI stake as of Jan 16, 2023 is worth $12.23 per IAC share by my estimate. In total, ANGI + MGM holdings are worth a combined $39.5 per IAC.

IAC Corporate Overhead

Corporate overhead for IAC is about $87 million in Adj. EBITDA for Q1 to Q3 2022, pro-rating to $87 million for FY2022. A 10% discount rate applied to run-rate equates to roughly $900 million in EV, or $10 per IAC share.

IAC Balance Sheet Items

IAC balance sheet items, including cash holdings, Dotdash Meredith net debt, and non-cash working capital, total to -$3.6 per IAC share.

IAC Total NAV

In the final analysis, also taking into account the valuations on Dotdash, on Turo, on Search, and on Emerging & Other segments illustrated in my previous pieces, I value IAC’s current NAV at $66.8/sh. This implies IAC is currently trading at ~20% discount to NAV.

Is IAC expensive? - not really

In my experience, SoTP stocks generally trade at a 10-30% discount to NAV anyways, so a 22% discount-to-NAV does not present a compelling long opportunity at this level.

However, my NAV is also calculated on what I think each of the assets may fetch at current, realistic liquidation values, as opposed to long term fair values. The public holdings are calculated at current market prices, which are readily available. The private holdings are also calculated based on what I believe the respective assets/company’s comparable pubic peers are CURRENTLY trading at. The Cash & Debt are calculated at book values, which are good proxies for liquidation/market value since these net debt, cash, working capital items are quite liquid.

On longer term fair value, the private holdings alone hold possesses the potential to grow from the current NAV value of ~$40/sh, which is based on public comps multiples that’ve experienced substantial contraction in 2022, fueled by series of global interest rate hikes and anticipations of economic slow downs. Further, both Dotdash Meredith and Search have been adversely impacted by macro slow down in the e-commerce / ad demand. Dotdash Meredith’s post-deal integration delays have also impinged on performance. However, though higher than 0% levels of interest rates will likely remain going forward, the e-commerce / ad market slow downs and Dotdash Meredith’s integration issues are in my view likely transient issues that should be resolved over the coming year or two. A lifting of these near-term overhangs should exert positive forces on Dotdash Meredith and other private holdings via multiples expansions and incremental chunks of revenue/EBITDA growth.

To wit, Dotdash and Meredith prior to the merger at Dec 2021 generated a combined EBITDA of $450mm for FY2021. For FY2023, the combined EBITDA by my estimate drops to only ~$260mm before Meredith-related corporate expenses. The significant drop in EBITDA is based on certain assumptions and forward-looking intimations that I’ve extracted from management’s Q3/22 remarks reflecting the sustained ad-market slow down and Dotdash’s internal integration issues. Notwithstanding the slow down, I deem it rather unlikely that Dotdash Meredith’s EBITDA had peaked in FY2021. The growth prospects of the business is still there, so after integration issues and ad-market slow down, EBITDA should recover, then surpass pre-merger levels of $450mm.

Management has elucidated that at $1 billion in Dotdash Meredith digital revenue, for every $1 in revenue, roughly $0.50 to $0.60 becomes EBITDA, so to grow EBITDA from $200mm in FY2023 to $300mm, revenue would have to grow to $1.2 $1.3 billion, or 20% to 30% from my FY2023 estimate revenue of $980 million. Based on historical Dotdash Meredith growth rate, this can be achieved in 2025/2026. Based on a 10x revenue multiple, Dotdash Meredith would be worth $3 billion or $33/sh by 2025/2026, implying a $10/sh NAV growth over the next 2-3 years from the current NAV o $67/sh.

Other segments such as Turo, Search, Care.com should see similar-in-concept valuation growth over the coming years if the standalone fundamentals of these businesses remain steadfast over a recovering macro environment, so in my view, IAC’s private holdings offer a decent NAV growth from the current level, where a confluence of overhangs – consisting of interest rate hikes, macro-slow down in e-commerce/ad market, and IAC post-deal integration delays – has temporarily atrophied IAC NAV to a depressed level amidst the current environment. As these overhangs expectedly dissipate, the future looks brighter, so valuations in my opinion likely to head higher than lower.

Given this NAV growth prospect, IAC’s valuation at a 22% discount to its current, depressed NAV doesn’t look too shabby, and presents a decent entry point to get involved in the growing NAV story at IAC.