Post Views: 2,832

The Opportunity

Here is a Japanese net-net stock that popped on my radar. I should preface the following write up with the disclosure that I’ve only spend some brief time on this one because it won’t be a big position, but shall become a small constituent of basket of net-net stocks that I plan to hold. It might not work out, but I postulate that holding a number of these similar-in-kind small-cap net-net stocks vetted through a rudimentary process should yield better than market-index returns since my book is nimble enough that these small caps still make difference for my return.

Sanei Architecture

SANEI ARCHITECTURE PLANNING CO., LTD (3228 JP EQUITY) is a Japanese homebuilder founded in 1993. The developer builds “urban three-story houses” in Japan, supplying approximately 2,000 housing units annually. Sanei is also planning new development in Los Angeles and Vietnam as parts of international expansion efforts.

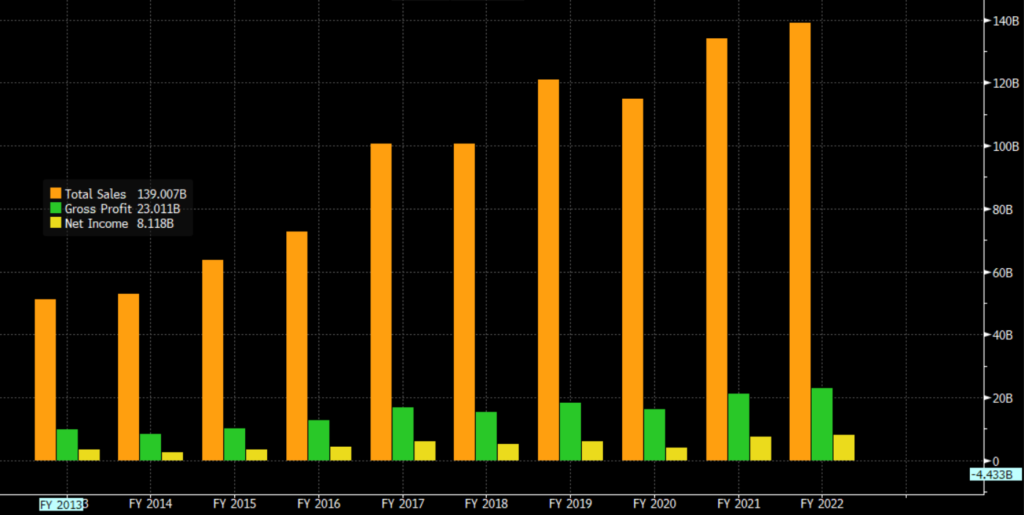

Total sales have grown over the past 10 years, along with consistently positive operating profits, but these feats aren’t the focus of my long thesis on this name.

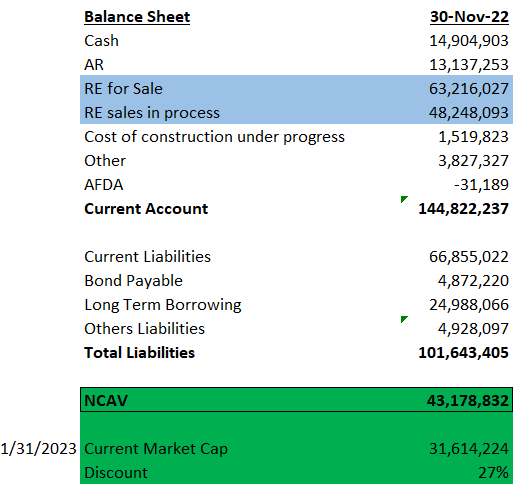

Rather, in my view, an opportunity appears now because for the first time in 10 years, Sanei is trading below liquidation value if the value of its real estate for sale is included. Current account as of the latest quarter date of Nov 30, 2022 was reported at 144.8 billion yen. The substantial portion of this figure is the 111 billion yen in the real estate assets for sale (blue rows below).

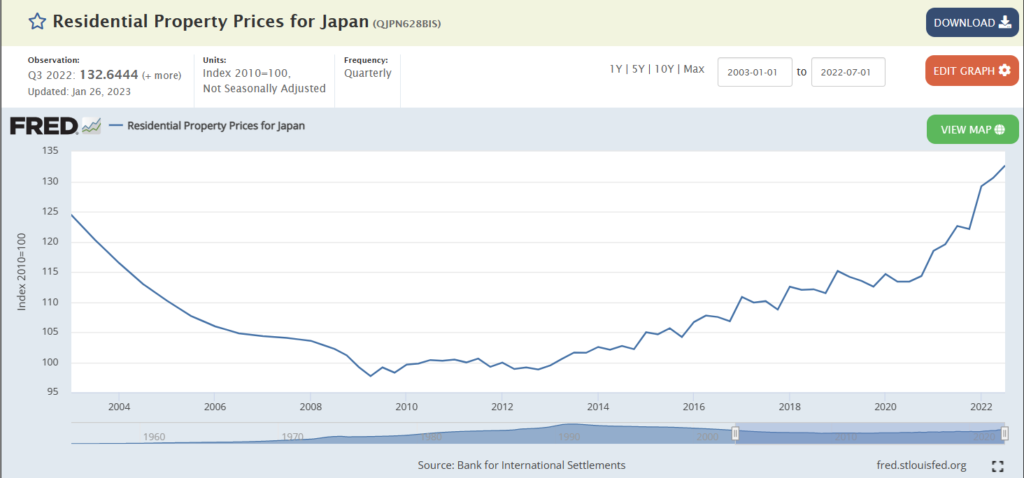

Should the company hypothetical undertake a liquidation process, this figure in my opinion arguably should be a down-to-earth proxy for how much these real estate assets could fetch because the Japanese residential property prices continues a steady uptrend. Therefore, whether these real estate for sale is recorded at cost or at estimated market value at the time of reporting date, the 111 billion yen is more unlikely than likely to be inflated figures – because market value for residential properties have gone up since 3 months ago…

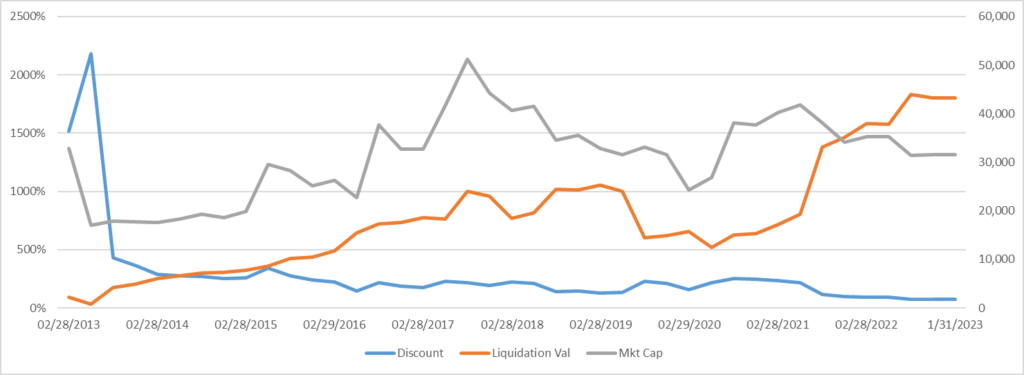

At 43 billion yen for NCAV (current asset – total liabilities) vs. current market cap of 31.6 billion yen, Sanei is trading 27% below liquidation value. For some Japanese small caps, NCAV above market cap is the norm, but not for Sanei, as it had historically traded above NCAV value since at least beginning of 2013. Only since beginning of 2022, did it become a net-net stock.

It’s unclear to me what exactly caused this to happen, but I’ve not come across any operational red-flags that could be the culprit, so my hunch is that trading sentiment/mechanics and outlook on near term profitability all could’ve weighed on stock price while NCAV eclipsed above market cap. Nonetheless, profitability remains positive and NCAV is growing, so I’m long on the bet that market cap will have to catch up to liquidation value at some point.