Post Views: 2,748

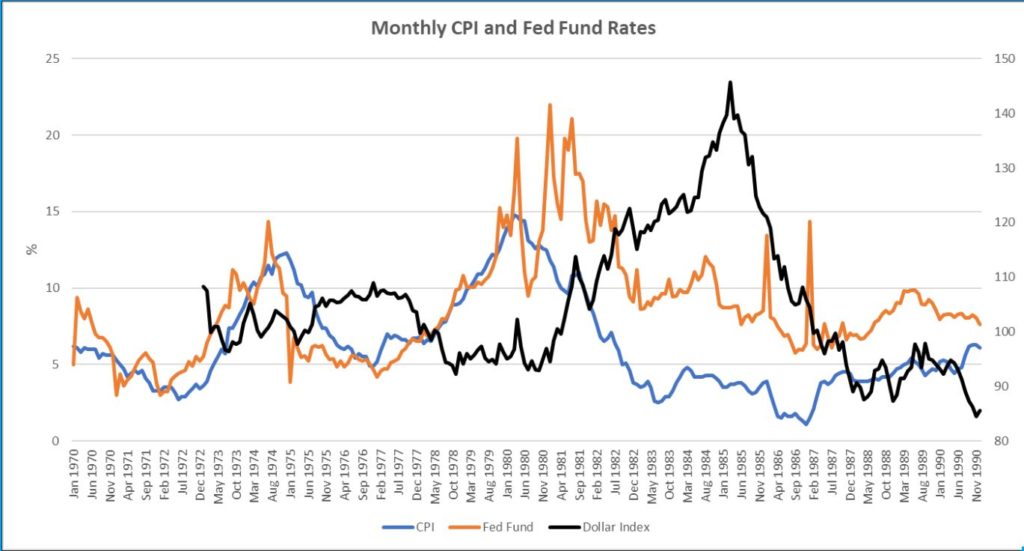

The dollar went off the gold standard in 1971. From Sep 1980 to Feb 1985, the dollar rallied on its first bull run, which remains the longest and strongest dollar rally since the free float of the dollar.

A couple of forces compelled the rise of the dollar during this period. First, the US fed fund rate hikes from late 1979 to Jul 1981 created upward pressure on the dollar. Paul Volcker had become the chairman of Board of Governors of the Federal Reserve System (Fed) on Aug 6, 1979 by the appointment of Jimmy Carter following sharp rise in inflation between 1978 and 1979.

Volker quickly addressed the rapid rise of inflation by hiking interest rates, something that contributed to the recession of 1980/1981 and drew correspondent political backlash during the economically tumultuous early 1980s. After raising fed fund rate to 17.61% in Apr 1980, he relented and briefly lowered rates from 19.8% in Apr 1980 to 9.5% in Jul 1980, but resumed the rate hikes again, back to 19.1% by Jan 1981. The second series of rate hike starting Jul 1980 coincides with the start of the rise of the dollar from Jul 1980 to Feb 1985.

However, the dollar would continue to appreciate for several years after the Fed had eased off the pedal on rising interest rates to combat inflation. After Fed Fund rate had peaked in Jan 1981, the dollar went on an essentially unobstructed ascent for another 3 years, eventually peaking at Feb 1985. My research suggests that what appeared to have sustained the persistent rise of the dollar – after hawkish fed policies had begun to dissolve in 1981 – was the expansionary policies of Reaganomics, which in turn led to higher levels of long term interest rates, attracting capital inflow.

Expansionary fiscal policies can create upward pressure on a currency over the short term (which I shall approximate as 1 – 3 years) because higher government spending and/or accommodating tax policies induce economic demand, calling for higher interest rates to tighten demand.

Ronald Reagan was elected president from 1981 to 1989. Less than a year in office, the Reagan administration passed the Economic Recovery Tax Act of 1981, aggressively cutting personal taxes to stimulate the economy. In a period of stagflation in the US, Reaganomics further instituted:

- widespread tax cuts,

- decreased social spending,

- increased military spending, and the

- deregulation of domestic markets

- outsourcing to private businesses

- Foreign Direct Investment (FDI) in the US.

These policies led to spending that fueled a growing federal deficit, which evidently was negatively correlated – and I would argue caused – the rise of long term interest rates. Further, Regan was also a dollar bull, believing that a strong dollar represented a vote of confidence in America by the world. I believe the combination of the expansionary policies and the administration’s bullish preference for the dollar in my view elevated the dollar.

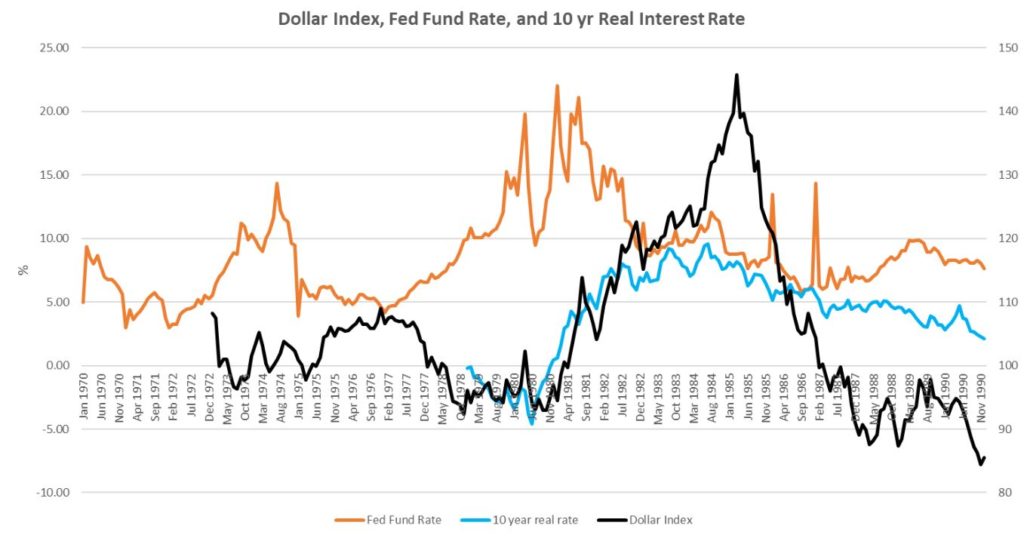

More crucially, 10 year REAL interest rate continued to rise even though Fed Fund rate had been brought back down from the peak of Q1/81. The graph presents a visual depiction of the interplay between dollar, fed fund rates, and 10 year real interest rate. Notice the orange line (Fed Fund Rate) had peaked and started to tumble in Q1/81, but the black line (Dollar) continued to rise in tandem with the light blue line (10 year real interest rate). So even though fed fund rate was in a downtrend, long term real interest rate continued on an uptrend, in tandem with the Dollar.

Of course the magnitude of the rise in the 10 year real rate is not as large as that of the Dollar index, but I believe the rise of the dollar during this period was certainly rationalized by climb of the 10 year real rate, without which the appreciation of the dollar would’ve more likely faded.

The strengthening of the dollar in 1984 now appears parabolic in retrospect, but this behavior looks to me quite typical of financial security pricing at the end of a long-duration trend. Just as there are inertia in physical motion, so there is also inertia in the movement of financial securities pricing. Adhering to this principal, the dollar reached its climax in Mar 1985 after a almost 5 years unabated upward trend.

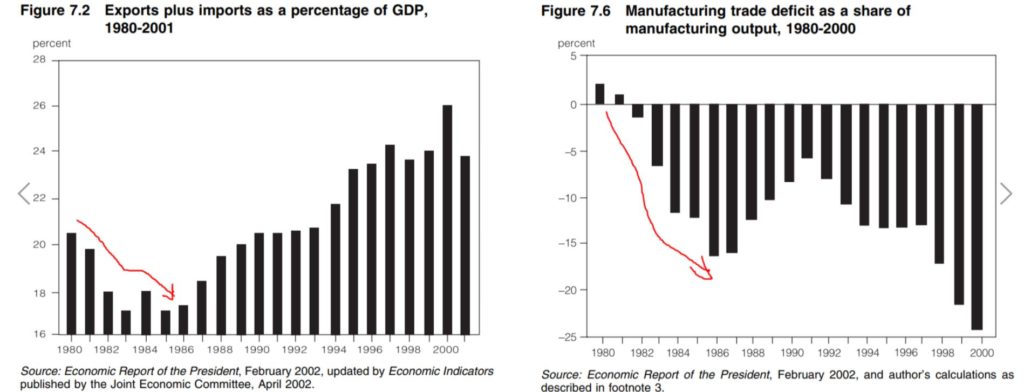

The effects of the dollar’s appreciation during this 1980 to 1985 were visibly felt in the real economy. Export plunged relative to imports as the dollar-priced domestic goods became expensive vis-a-vis foreign ones and the trade deficit grew.

The call for intervention to weaken the dollar grew louder. In 1985, the government stepped to execute an unprecedented, globally coordinated effort to depreciate the dollar. As a result, the dollar tumbled in the subsequent years, to a lower than what it had been worth at the beginning of 1980, the start of the dollar bull market.

How did this unfold? Stay tuned for the next part in this series.