Post Views: 1,531

It is now 2021… and no matter who you are, you’ve probably heard about “Bitcoins” somewhere at some point in recent years, whether from a friend/family, the media (most common), your co-worker, or Bob the-always-half-naked-dude down the block. Yet despite how ubiquitously “bitcoin” seems to be plastered everywhere, most people still couldn’t really wrap their heads around it. A recent survey by CivicScience found that in the US alone, 84% of adult Americans don’t really know much at all about Bitcoin. And despite of the hype from early adopters about how Bitcoin is going to “change the world”, the percentage of Americans invested in bitcoin is only 9%… and this after a “50% increase” in cryptocurrency investors in recent years. (you know… because going from 6% to 9% is a 50% increase…).

I was with some friends the other day and the conversation invariably turned to investing at some point during the evening. When I mentioned cryptocurrencies and bitcoins, there were quite few blank faces that fell silent and seemed to couldn’t care less… When I mentioned the basics and Bitcoin’s potential prospects as a (speculative) investment, I felt as if I were pitching people to buy turbo-jet-engine for their honda civic.

It really doesn’t have to be this way, because the Bitcoin is actually not difficult to understand…

While I don’t recommend people just throw their money in cryptocurrencies such as bitcoin without deep due diligence – as they are still highly volatile and speculative – I do think there is utility in at least taking some time to understand what a Bitcoin is…

The world is evolving quickly, and emerging technology are presented to us all the time. We should make a habit to at least keep up with the basics, lest you want to feel like living under a rock.

And the thing about Bitcoin is… It’s actually not difficult to understand. So below is my attempt to explain to the layman what is Bitcoin.

What is Bitcoin and How does it Work

Bitcoin is a digital/virtual currency invented in January 2009 by its mysterious founder/s that goes by the alias “Satoshi Nakamoto“. Unlike gold which has a physical presence, Bitcoin is virtual and essentially exists as a computer algorithm/software that is run/stored on a network of computers worldwide. In this sense, Bitcoin is like a website, which has no physical address and cannot be touched or tasted but nonetheless exists as websites are maintained on a bunch of computers (known as servers) and can be accessed via your computer/electronic devices…. However, unlike a website, which you would access via your browser by entering the website address, Bitcoin has no “website”. Instead, you establish through various online exchange/institutions a Bitcoin wallet (think of it like an email account or a Bitcoin bank account) to store (and buy/sell with real money) bitcoins and send/receive your bitcoin to/from other bitcoin addresses (other people’s “email address” for bitcoins account). In this sense, sending/receiving Bitcoins is exactly like sending/receiving real money with your actual online bank account, except you are not dealing in real USD or Euro, Chinese Yuan or whatever actual money currency you use, but dealing in Bitcoins…

The purpose of Bitcoin is to offer an alternative medium of exchange, so that one day you may purchase that new pair of shoes with Bitcoins instead having a $35 charge to your credit card. Instead, you would login to your online bitcoin account and send 0.00005 bitcoins to your shoe sales man…

Well so far this is all very pointlessly redundant isn’t it? Why go through all the hassle to create and implement a virtual currency like Bitcoin when we can already transact the same way using real (fiat) money!?!?

The answer lies in how transactions are recorded when made… Let’s take a look at what I mean by this…

When you purchase a new Garden Gnome from Amazon using your credit card, a charge is made to your credit card company, who then records the transaction for your account. And now you owe your credit card company $35…

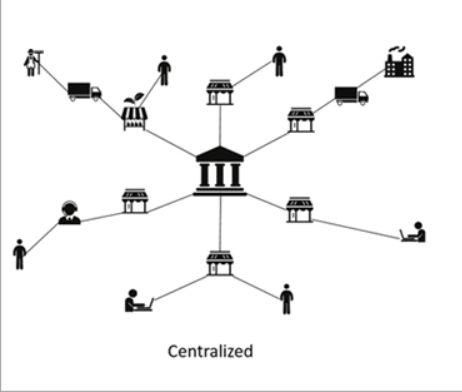

To most people this should be an intuitive process. But it is important to highlight here that when you make a purchase in this instance, it is your credit card company – not the government, not you, not your neighbour, not even the seller from whom you are buying the product – that is solely responsible and capable of recording your credit card transaction. So if the credit card that you are using is a Visa, the transaction that you just made will get recorded on Visa’s company computers/databases. Mastercard company’s computers has got nothing to do with this. The onerous lies on one party – in this case Visa – to record your transaction. And somewhere in Ashburn Virginia are a warehouse full of computers (known as data centers) that are storing Visa transaction information, and one of these computers just wrote down that you bought a garden gnome on Amazon…

The problem with this approach to record keeping is that information is centralized as only the party keeping the record maintains full access to this information. So suppose there is an explosion on all of Visa’s computers, your transaction records are now gone, so if you send $3,000 to pay down your credit card debt, well now there might not be any record of that either…

Of course the likelihood is quite low that all of Visa’s computers explodes simultaneously and now you owe Visa a gazillon dollars… but this artificial example still points to the hypothetical flaw in a centralized record keeping approach, by which if information is stored only at one place and/or with one party, information may be forever lost if accidents or even manipulations happened to the one who stores the information.

Yet this centralized record keeping is the conventional, default approach our world adopts with just about every kind of information, especially financial information. In addition to charges/transactions made to credit cards, whenever we use our bank accounts, transactions made from or to an account – be they debit or credit – are also only stored/recorded by only our banking institutions. So if you own a bank account with JPM, all your JPM bank account transactions are only recorded by JPM’s computers (and their accountants who hide inside of the computers with papers, pens and sometimes erasers).

Similar to the Visa example, if JPM in this instance were to experience some kind of operational calamity (like a tornado, or getting hacked by bad apples, or both…), information stored by/at JPM may be lost forever… and you could say goodbye to your bank account and your retirement savings… Again, the likelihood of this is virtually non-existent, so please don’t turn away from conventional banking because of my over-the-top hypotheticals (nor do I want to get sued from JPMorgan for saying on the internet that their customers bank accounts are going to poof away)… but these illustrations do somewhat make evident of the potential weakness inherent to centralized information record keeping… You put all your eggs (information) in one basket, you might risk losing them if that one basket breaks…

So what’s the remedy here? Enter DE-centralized information record keeping. This means Bitcoins of course…

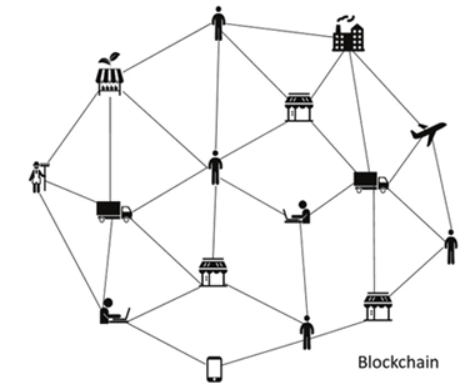

Unlike traditional centralized information keeping, a decentralized system has no primary/central point where information are exclusively stored. Instead, an entire network of computers maintains all of the information simultaneously, and every computer within that worldwide network has access/stores the same information because the identical information is stored on every single computer – none is irreplaceable. So if any one computer, or any 10 computers, or any country or any combinations of countries’ computers goes down, all information previously stored on those lost computers are still stored on all of the remaining computers in a decentralized computing network. That means if Grandma’s computer is hooked up to the decentralized network, and all of Europe’s computers are taken out… well, Grandma still got you covered…

This decentralized information keeping system is also known as Peer-To-Peer networking. And Bitcoin aside, most people have already used this type of information keeping in the form of torrenting…

When you pirate that new marvel super hero movie (which are all crap by the way… don’t watch them…) or a new song from a torrenting software, you download the movie/song from bunch of other computers all storing the same content. And if any one computer from which you are torrenting goes offline, the remaining ones still will provide you the content to download…

Bitcoin is conceptually the same thing… Whereas in torrenting, you are downloading movie/music/whatever from a bunch of other computers all storing the same content, in a bitcoin network, every computer holds the identical information about all of the bitcoin transactions ever made since its inception (such as Johnny send Sarah 3 Bitcoins 5 minutes ago. On Oct 12, 2013 3:30:40pm 35 bitcoins were send from this address to that address etc. etc.).

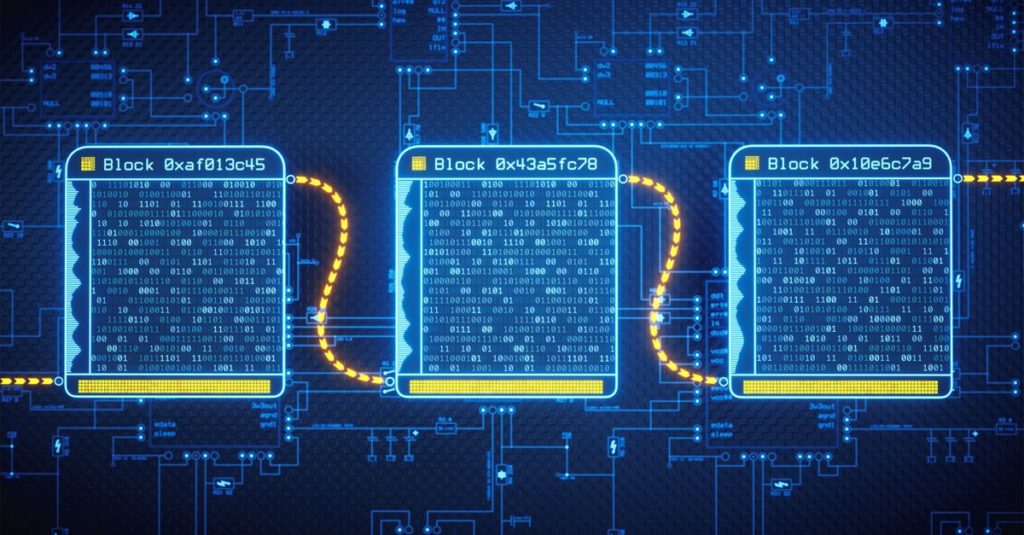

This decentralized network of computers that is keeping the entire record history of bitcoin transactions is run on a “protocol” (think of it like a software, or a set of rules/parameters by which the computers talk to each other / work together) is called the technology called the “blockchain”, and the core concept of the Blockchain is simple… Each block is a parceled containment of electronic information, and each block is connected to another block of information, forming a chain of information blocks…. Hence the term block…chain…

The technology of blockchain is applicable beyond just Bitcoin as we could store all kinds of digital information in blocks. For example, everyday you can look up at the sky and describe what you see and how your mood is, then record these information in a digital block. Now suppose you put one day worth of information in a block, then after 10 days of recording, you’d have a blockchain of 10 blocks, each of which containing an individual day of information on what the weather was like and what you mood was like for the corresponding day.

For Bitcoin Blockchain, each information block contains ~500 Bitcoin transactions (which takes up about 1MB of data storage). Currently, there are ~700,000 Bitcoin blocks recorded (or mined). Since each block contains about ~500 Bitcoin transactions, this means that to date there has been 350 million bitcoin transactions made, all recorded on the Bitcoin blockchains.

To recap, centralized information record keeping means a specific party records all of the information while a decentralized information record keeping means a distributed network of computers all simultaneously keeps the same information. In a decentralized network, the information are archived in the format of blockchains, in which each individual block contain digital information and each individual block is linked to another one in the form of a chain. Hence the term blockchain.

Cementing this abstraction in the context of Bitcoin, a distributed/decentralized computer networks (all over the world) all keep information about bitcoin transactions. These bitcoin transactions are kept in the format of Bitcoin Blockchain, in which each individual bitcoin block contain ~500 bitcoin transactions since the birth of Bitcoin in Jan 2009. Each individual Bitcoin block is linked to another in the form of a chain. And so far, there are ~700,000 Bitcoin Blocks in the Bitcoin Blockchain, implying that roughly 350 million bitcoin transactions have already been made/recorded (500 * 700,000).

The advantage of the bitcoin blockchain is that of a typical decentralized computer network, in which no individual computer/set of computers are irreplaceable. If tomorrow a nuclear bomb explodes in any one country or a set of countries, the bitcoin blockchain will still be alive and well because Bitcoin networked computers are all over the world and the survival of bitcoin does not depend on the computers in any country or even continent/region…

So what and who runs the computers on the bitcoin’s decentralized network? How do they work together in keeping the bitcoin blockchain alive and working and how do they coordinate with each other across geographies, institutions, languages and political systems that vary across the world?

This is where Bitcoin Mining comes in… Tune in next time…

Hope you enjoyed this article. Let me know if you have any questions or comments. I’d love to hear from you. Enjoy your summer.