Post Views: 3,526

IAC's Emerging & Other Segment

IAC’s Emerging & Other segment currently consists of a collection of businesses under development. The preponderant of these businesses are essentially websites/online platforms providing niche-services. The crown jewel of the segment is the care.com business.

Care.com

In Feb 2020, IAC acquired Care.com, an online marketplace for people to provide and obtain caregiver services for children, tutoring, pet, housekeeping, senior care, and special needs. Through the website, care.com matches customers and care providers of these care services akin to what airbnb does for real estate rentals and what Turo does for car rentals. Care also provides its own set of customer payment solutions enabling consumers various payment options, autopay, payroll processing, tax filings. For corporate customers providing their employees benefits of caregiving services, Care.com also provides enterprise-based accommodations entailing comprehensive suites of services for employees who needs alternative child care, services for consultations on work-life challenges, etc.

Revenue is generated via subscriptions fees from customers and care providers using care.com as well as from annual contracts with corporate customers procuring care services for employees.

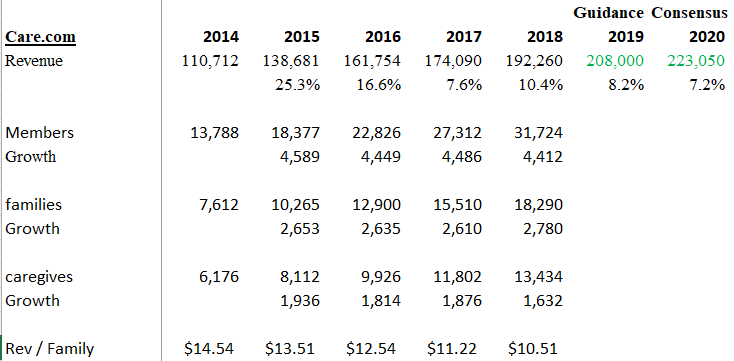

Prior to IAC’s purchase in Feb 2020, Care.com was growing, but topline growth had started to decelerate while memberships grew at a linearly steady pace.

IAC comments at a GS conference on Sep 13, 2022 provided some context around the pre-acquisition care.com…

“when we bought it, […] it was a challenged company struggling on background checks, overall marketing number of areas. The last 2 years were really about improving the platform, improving service provider management, building out the technology and then rolling out some of the newer projects like — products like Instant Book.”

Since the acquisition, Care.com figures are no longer disclosed, but LTM revenue ending Q1/22 was $340+ million while IAC has mentioned that it expects 10-20% growth y/y for 2022. Extrapolating on these figures, I’d ballpark FY2023 revenue for Care.com to be $370 million at rudimentary approximation. IAC has indicated on multiple occasions that care.com is the gem of the Emerging & Other division and that it remains steadfast on making transformational investments in care.com to achieve organic growth, based on the view that the migration from offline to online for senior / child care is a compelling opportunity to capitalize on.

What is care.com worth?

At $500 million enterprise value in 2020, Care.com was purchased at 2.2x EV/2020 Revenue. Given the value-added work that IAC has performed on Care.com including adding new services such as instant book, Care.com should be worth more than IAC’s cost basis. But realistically, how much would a willing buyer pay for the current care.com in today’s environment?

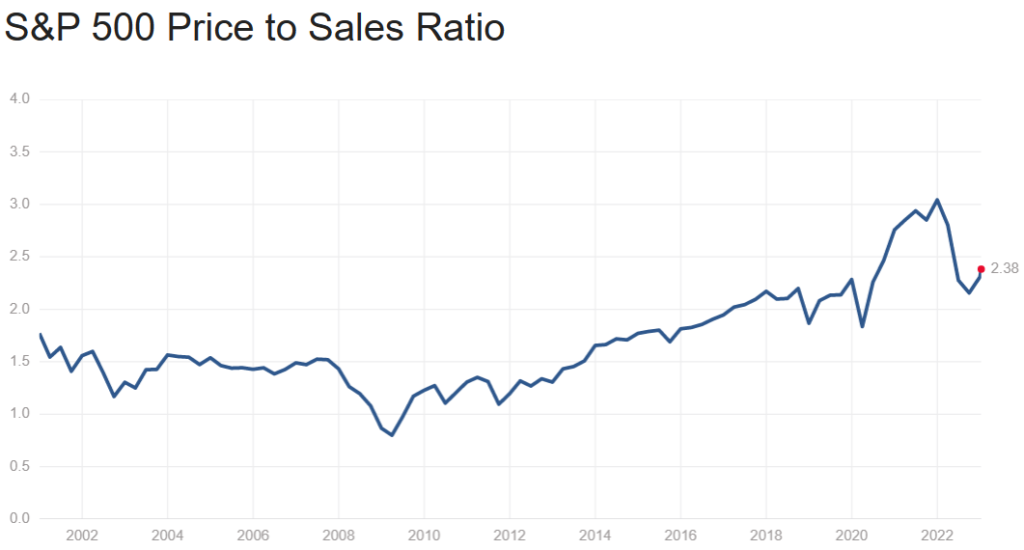

Given care.com is still a work-in-progress and margin expansion from 10% has not been a focus by IAC, I doubt anyone would pay a high premium multiple for care.com in its current form. It’s difficult to find comps for care.com, but since Feb 2020, multiple for the market has risen and fallen, but now SPY 500 P/S ratio is where it was in 2020 before the pandemic – at around 2x, close to where care.com was purchased in 2020.

Rest of the Emerging & Other

The rest of Emerging & Other segment is comprised of

- Mosaic Group – a developer and publisher of subscription-based mobile apps including Communications (RoboKiller, TapeACall), Language (iTranslate, Grammatica), Weather (Clime: NOAA Weather Radar Live, Weather Live), Business (PDF Hero, Scan Hero), Health (Daily Burn, Window – Intermittent Fasting) and Lifestyle (Blossom, Pixomatic);

- Bluecrew – a job search website for hourly-wage based / service related jobs such as bartenders, warehouse specialists, forklift, dishwasher, cook etc.

- Vivian Health – a job search website for healthcare professionals

- The Daily Beast – a news blog

- IAC Films – a movie production company for international and US films

- Newco – the IAC incubator company with a portfolio of ventures in social gaming, telehealth, home services, social media, and online recruiting

Revenue and other figures are not broken out for any of these businesses, but LTM revenue for this aggregate portfolio ending Q1/22 can be back-calculated to be $350+ million, likely half of which I estimate to be revenue from Mosaic Group, as a 2019 article had stated that Mosaic had $123 million in revenue at the time. The 10ks and 10qs also provide a sufficient grounds for the derivation that the emerging & other segment excluding care.com has been growing at single digits y/y in 2021 to 2022.

Extrapolating on this single digits growth rate, I estimate FY2023 revenue for Emerging & Other ex. Care.com at $367 million, roughly equal to that of Care.com. Qualitatively, the revenue at these businesses will be inferior to care.com’s revenue since the latter is an established business and the gem of IAC’s Emerging & Other segment, so I reason to apply a much lower EV/REV multiple to the the rest of the Emerging & Other, at a de-minimis 0.2x multiple (10% of care.com). This yields to an enterprise value of $74 million, or $0.8 per IAC share for the Emerging & Other segment ex. Care.com.

Final Valuation

In the final analysis, I value Emerging & Other segment in aggregate at $9.2 per IAC ($8.3/sh for care.com + $0.8/sh for ex. co).