The US dollar persists in its strength against all other currencies, because the overall narrative continues to point to the Federal Reserve as the most hawkish vis-a-vis all other central banks.

Two weeks ago, right after I published the Jul 26, 2022 article on going long USDJPY, FOMC meeting announced the next day and the release jolted the market into a bullish frenzy that’s yet to abate since.

So what happened?

Well, On Jul 27, 2022, the fed communicated to the public via the FOMC releases that the economy seemed to have weakened in some regards. According to Beige Book, one of the official /research referenced by the Fed to arrive at policy/rate decisions, Jun 2022 saw slow down in real estate activities, and most survey participants expected the next 6 to 12 months to see weaker business conditions. Because of these type of weakness, Fed hiked 75 bps – as expected – and stated that it will hike in the future episodes as economic data would suggest.

Combine this non-committal language for an aggressive hiking trajectory and the reporting of weaker overall economic conditions, the market took these as signs that the Fed will become more dovish in the future, because inflation will be weaker going forward. So the market rallied as future expectations of interest rates are anticipated to be accommodative. Hence, boosting assets prices.

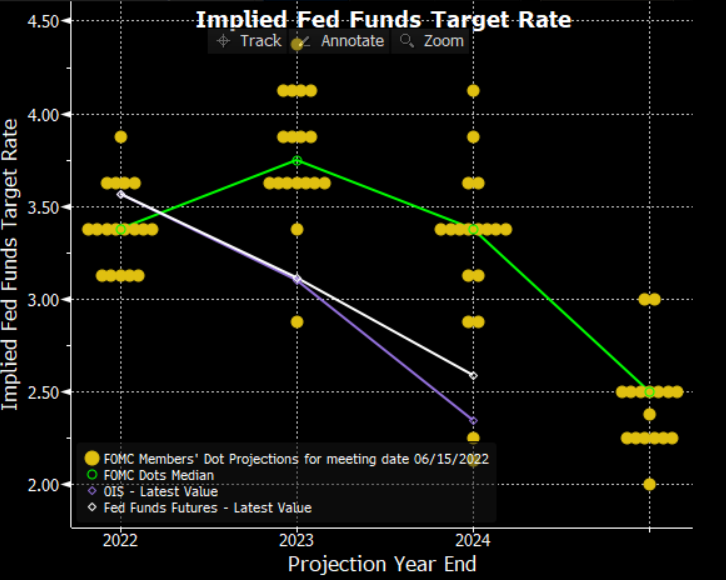

So while the Fed has not in any tangible ways indicated that the future hikes will not be aggressive, the market took the liberty to presume already that the inflation will be low in the future, so the hikes in responses will be muted. This extra-ness in the market’s implicit expectation is reflected in the current bond pricing, which shows that the market based on futures pricing is assuming that the fed will be cutting rates in 2023 and 2024, whereas most of the Fed officials by latest outlooks point to Fed continuing to hike in 2023.

Can we really assume that Fed will not hike aggressively in the future because the high inflation – against which the the fed is combating by hikes – has already been / is being tamed?

There certainly has been no signs that inflation is slowing down. Yesterday’s jobs number also shocked many (not me) that job growth remain robust. Of course, job and wage growth are lagging indicators, so it’s actually erroneous to look at these indicators and assume that the market is doing well. Sure, commercial and residential real estate activities are slowing. PMI is down as well. But rental costs are like 45% of the CPI, and that’s not slowing down. Food/Beverage and Transportation are both 15% of CPI. These categories of purchases certainly are not cooling off either as people come back to work and even travel/tourism show no signs of slow down. Together, these 3 category accounts for 75% of the CPI, and they are still running hot.

My verdict is that the high-inflation we are experiencing is more resilient than what most of the market is estimating. To quote some of the more competent experts opinions that I’ve been following, this is the most heated inflation we’ve seen in 30 years. And 8-9% inflation simply cannot be swapped away like a impotent fly by two back-to-back 75% bps hikes from an interest rate of almost 0. Monetary policies also take time to take effect, so it’s been completely immature by some to assume inflation is already weak simply because rates were raised 6 months ago….

No, this inflation killing scheme will take time. We are just at the beginning of it.

I’m still long USDJPY despite a little hiccup since Jul 27, 2022. USD is strengthening against the Yen again. We should resume the trend of weakening Yen and stronger USD, on account of market eventually realizing that Fed hikes that is more aggressive than the market’s assumption are still on the table, so USD relative interest rate will continue to increase over the Yen.